I. Background and Mission

The MiraCosta College Foundation (hereafter referred to as the “Foundation”) is an

independent, 501(c)(3) nonprofit corporation created to support students by funding

their pursuits toward a higher education and providing the resources to help guide

them toward

success.

For over 40 years, the vision of the Foundation has supported the vision that no one is denied access to education because of financial need and that resources are available to enrich the college experience for all students. In service to this vision, the Foundation’s mission is to promote the interests and welfare of the college and to secure resources that will transform student lives.

II. Introduction

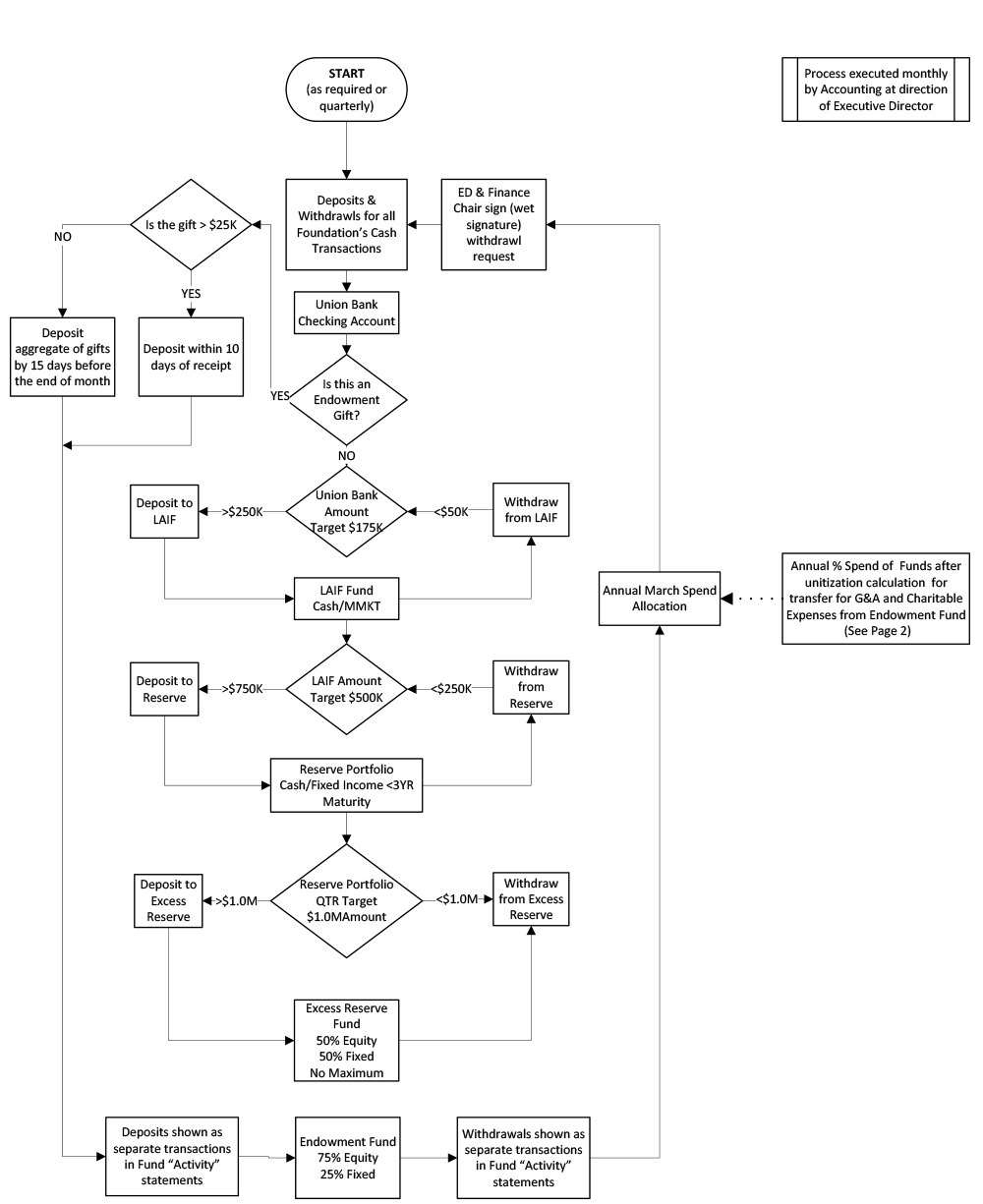

This policy is intended as a basic guide for safeguarding and managing the Foundation’s assets including the development of spending goals, investment strategies (including asset allocation) and investment performance review and reporting collectively comprise the “Portfolio”. The Portfolio’s assets will normally be held in one of four subordinate portfolios (or pools). These are (1) the “Reserve Portfolio” (2) Excess Reserve Portfolio (3) the “Endowment Portfolio” and (4) Title V Grant Endowment.

This investment Policy Statement sets forth the investment objectives, distribution policies, and investment guidelines that govern the activities of the Foundation and any other parties to whom the Foundation has delegated investment management responsibility for Portfolio assets.

The investment policies for the Foundation contained herein have been formulated consistent with the Foundation’s Mission, reflects its anticipated financial needs and its willingness to assume investment and financial risk, as reflected in the majority opinion of the Foundation.

Policies contained in this statement are intended to provide guidelines, where necessary, for ensuring that the Portfolio’s investments are managed consistent with the short-term and long-term financial goals of the Foundation. At the same time, they are intended to provide for sufficient investment flexibility in the face of changes in capital market conditions and in the financial circumstances of the Foundation.

III. Role of the Finance Committee and the Foundation Board

The Foundation Board (the “Board”) has a fiduciary responsibility to comply with the

restrictions imposed by the donors of endowment funds. The Board also has a legal

responsibility to ensure that the management of endowment funds is in compliance with

the

Uniform Prudent Management of Institutional Funds Act (UPMIFA).

The Finance Committee of the Foundation Board (the “Committee”) acts in a fiduciary

capacity with respect to the Foundation and is accountable to the College and the

Board for overseeing the investment and safeguarding of all assets owned by or held

in trust.

Foundation Management (“Management”) is defined as the Foundation’s Executive Director

who oversees endowment accounting and makes recommendations to the Committee.

- The Committee will review this Investment Policy Statement at least once per year.

Changes to this Investment Policy Statement can be made only by affirmation of a majority of the Committee, and final Board approval. Written confirmation of the changes will be provided to all Committee members and to any other parties hired on

behalf of the Foundation as soon thereafter as is practicable. - Standard of Fiduciary Care. The primary and constant standard for making investment and spending decisions for all Portfolio assets is the “Prudent Person Rule” which states that “the members of the governing board shall act with the care, skill, prudence, and diligence under the circumstances then prevailing a prudent person acting in a like capacity and familiar with these matters would use in the conduct of an enterprise of like character and with like aims to accomplish the purposes of the institution” in compliance with Uniform Prudent Management of Institutional Funds Act.

IV. Manager Selection

Investment management of the Portfolio (including its constituent pools) shall be recommended by the Committee for approval by the Board based on a selection process as established by the Committee. The Committee may elect to appoint a single manager for the Reserve Portfolio, Excess Reserve Portfolio, Endowment Portfolio, and the Title V Grant Endowment Portfolio, or separate managers for each. The Committee may also elect to manage the Reserve Portfolio itself. In addition to evaluating a manager’s historical performance compared to appropriate benchmarks, a manager’s ethical standards, financial viability, organizational structure, experience of key personnel, and investment philosophy will also be reviewed.

V. Investment Objectives

- The Endowment Portfolio is to be invested with the objective of preserving the long-term, real purchasing power of assets while providing a relatively predictable and growing stream of annual distributions in support of the institution. The attainment of this broad objective will provide a balance between current spending needs of the Foundation and the need to preserve the purchasing power of the endowment for future generations. It is the Board’s intent to invest all long-term funds using the same target allocation, whether funds are endowed or Board designated/quasi-endowed funds. Gifts with donor restrictions will be invested as per instructions.

- The Reserve Portfolio. Assets apportioned to the Reserve Portfolio are intended for use “on demand” are to be invested with the objective of preservation of capital and short-term liquidity. Only high-quality short–term investment vehicles are appropriate for this portfolio.

- The Excess Reserve Portfolio is to be comprised of funds that are above an approved threshold to adequately fund the Reserve Portfolio. Assets in the Excess Reserve Portfolio are intended to preserve capital, provide a relatively predictable stream on income, and achieve moderate growth of principal. Assets are to be used as a supplemental source of funds for the Reserve Portfolio.

- The Title V Grant Endowment is to be comprised of Endowment Fund corpus (an amount

equal to the endowment challenge grant or grants awarded under this part plus matching

funds if available) and Endowment Fund Income (an amount equal to the total value

of the fund, including appreciation and retained interest and dividend, minus the

endowment fund corpus). Each endowment challenge grant awarded must be matched by

the Foundation, must be invested by the Foundation, and must have a duration of 20

years (Please reference spending rules in grant document PART 628 for additional spending

rules).

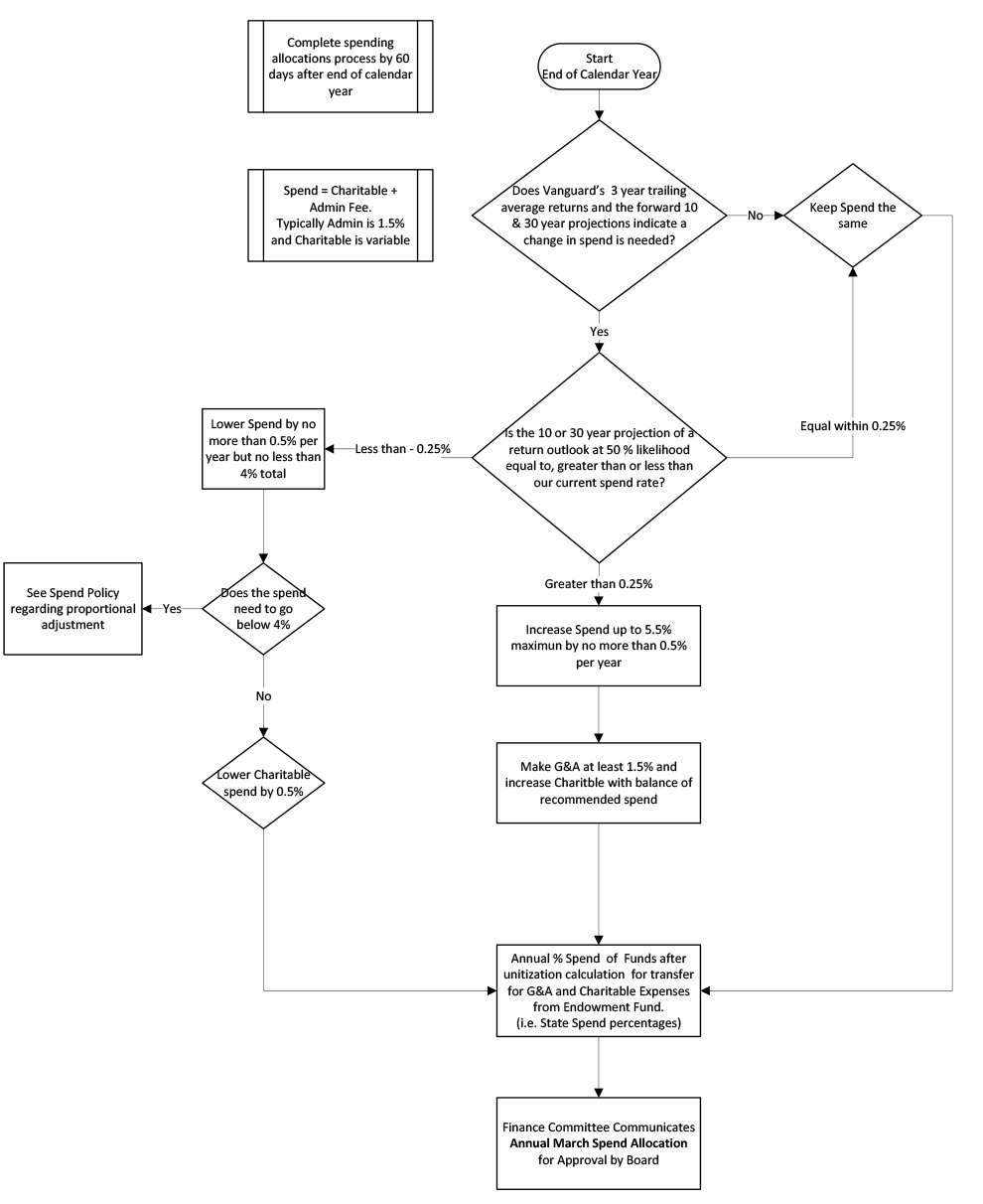

NOTE: Please reference the Investment and Spending Policy Flow Chart located within

the appendix.

VI. Solicitation and Acceptance of Gifts Policy

- A separate policy has been adopted and approved by the Foundation to provide general

information about the criteria and framework by which donations may be accepted or

recommended to the Board for acceptance. This information should not be interpreted

as legal advice, nor is the policy intended to override current IRS code and regulations.

This policy includes:

• Special gifts acceptance

• Gifts of tangible property and equipment (gifts-in-kind)

• Gifts of real property

• Gifts of securities, limited partnerships and other tangible property

• Gifts of life insurance

• Charitable Remainder Trusts

• Digital currency

VII. Spending Policy

- Foundation spending shall be funded from these sources:

- Current undesignated gifts (not designated as endowments),

- An annual endowment management fee (presently 1.5%) assessed on total Endowment Portfolio assets, and

- Partial distributions of net investment income (from interest or dividends) or net realized capital gains from the Endowment Portfolio

- Short term deficiencies or excess of cash needs may be balanced by withdrawals from/deposits to the Reserve Portfolio. Cash accumulations from earnings and capital gains that exceed the approved spending budget for any year will be reinvested.

- Purpose of Spending.

The Foundation exists to support the educational needs of the College. Consistent with prudent financial stewardship, the Foundation will spend its income each year for the purposes designated and/or approved by its Board. This will include a portion (1.5% endowment management fee) designated for the foundation’s business operations, fundraising and other work of the Foundation and a percentage set by the Board (currently 3.5%) for charitable purposes. Thus, the current spending rate is 5%.

Endowment Portfolio earnings in excess of the Board established spending rate will be reinvested in the Endowment Portfolio to protect the endowment’s purchasing power from one generation to the next.

NOTE: Title V Grant Endowment must be held for 20 years. Please reference spending rules in grant document PART 628. Title V Grant Endowment funds will not be included in the aforementioned ‘Purpose of Spending’.

- Limitations on Spending -- General Policy.

In general, current spending will not be funded by accessing the principal corpus of the Endowment Portfolio. The distribution of Endowment Portfolio assets will be permitted to the extent that such distributions do not exceed a level that would erode the Foundation’s real assets over time. The Committee will seek to reduce the variability of annual Foundation distributions by factoring past spending and Portfolio asset values into its current spending decisions. The Committee will review its spending assumptions annually for the purpose of deciding whether any changes therein necessitate amending the Foundation’s spending policy, its target asset allocation, or both. Establishing the Spending Rate. The Committee will review and recommend the annual spending rate to the Board within 60 days following the end of each calendar year. The Foundation presently seeks to maintain an annual spending rate of no more than 5.5% of the 3-year trailing average of the Endowment Portfolio (valued on December 31 of each year.) Any excess earnings will be re-invested into the Endowment Portfolio. An endowment management fee of 1.5% will be assessed first, then a maximum of 4% will be used for charitable purposes as designated by the donor or determined by the Board. (See Appendix 1 for related administrative procedures.) - Adjusting the Endowment Management Fee.

The Committee has the option of adjusting the endowment management fee up to the Uniform Prudent Management of Institutional Funds Act mandated maximum of 2%. The Committee also has the option of reducing the fee as long as the resulting fee income to the Foundation is adequate to fully fund operational and employee costs. (See Appendix 1 for related administrative procedures.) - Maintaining an Operational Reserve.

Recognizing that stability and continuity are important to good management and administration, the Management will seek to hold an operational reserve such that in down market years reductions in business operations and layoffs are unnecessary. In addition, Management will aim for a stable budget, and when necessary, plan for significant increases or cuts to the budget to meet extraordinary one-time costs.

VIII. Portfolio Investment Policies

- Diversification – All Portfolios

Diversification across and within asset classes is the primary means by which the Committee expects the Portfolio to avoid undue risk of large losses over long time periods. To protect the Portfolio against unfavorable outcomes within an asset class

due to the assumption of large risks, the Committee will take reasonable precautions to avoid excessive investment concentrations. Specifically, the following guidelines will be in place:

-

- With the exception of fixed income investments explicitly guaranteed by the U.S. Government, no single investment security shall represent more than 5% of total Portfolio assets.

- With the exception of passively managed investment vehicles seeking to match the returns

on a broadly diversified market index, no single investment pool or investment company

(mutual fund) shall comprise more than 20% of total Portfolio

assets. - With respect to fixed income investments, for individual bonds, the minimum average credit quality of these investments shall be investment grade (Standard & Poor’s BBB or Moody’s Baa or higher).

Other Investment Policies. Unless expressly authorized by the Committee, the

Portfolio and its investment managers are prohibited from:

-

- Purchasing securities on margin or executing short sales.

- Pledging or hypothecating securities, except for loans of securities that are fully collateralized.

- Engaging investment managers who promise to engage insuch practices.

B. Asset Allocation-General

-

- The Committee recognizes that the careful allocation of Portfolio assets among

financial asset and sub asset categories with varying degrees of risk, return, and

risk-return correlation will be the most significant determinant of long-term

investment returns and achievement of Portfolio objectives for each of the

Foundation’s Portfolios. - The Committee expects that actual returns and return volatility may vary from

expectations and return objectives across short periods of time. While the

Committee wishes to retain flexibility with respect to making periodic changes to

the Portfolio’s asset allocation, it expects to do so only in the event of material

changes to the Foundation, to the assumptions underlying Foundation spending

policies, and/or to the capital markets and asset classes in which the Portfolio

invests.

- The Committee recognizes that the careful allocation of Portfolio assets among

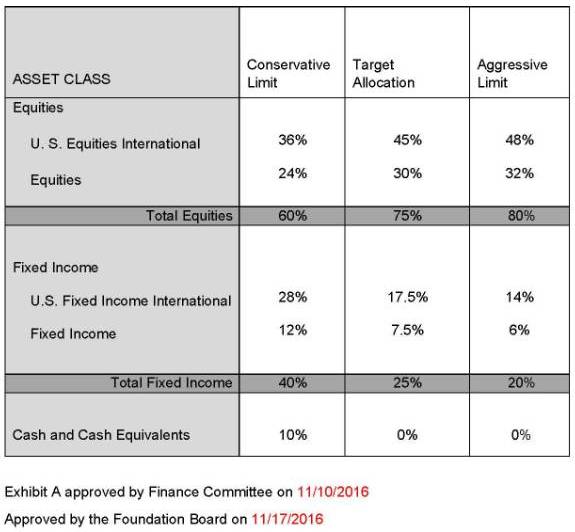

C. Asset Allocation Policy-Specific to the Endowment Portfolio

and Excess Reserve Portfolio

-

- Foundation assets comprising the Endowment and Excess Reserve

Portfolios will be managed as a balanced portfolio composed of two major

components: an equity portion and a fixed income portion. The expected role

of equity investments will be to maximize the long-term real growth of

Endowment and Excess Reserve Portfolio assets, while the role of fixed

income investments will be to generate current income, provide for more

stable periodic returns, and provide some protection against a prolonged

decline in the market value of the equity investments. - Cash investments will, under normal circumstances, only be considered as

temporary holdings in the Portfolio, and will be used for Foundation liquidity

needs or to facilitate a planned program of dollar cost averaging into

investments in either or both of the equity and fixed income asset classes. - Exhibit A (below) presents the long-term strategic asset allocation

guidelines, presently determined by the Committee to be the most

appropriate for the Endowment, given the Foundation’s long-term objectives

and short-term constraints.

- Foundation assets comprising the Endowment and Excess Reserve

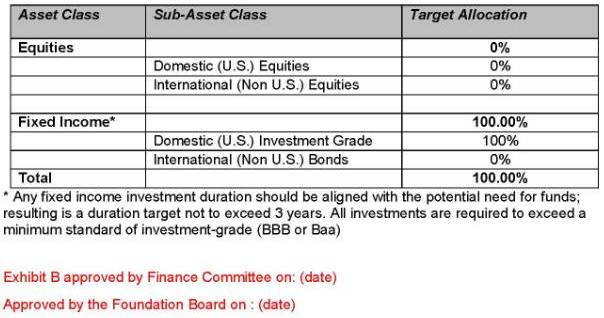

D. Asset Allocation Policy-Specific to the Reserve Portfolio

Assets are to be invested in cash or cash/equivalents or as outlined

in Exhibit

B (below). Any fixed income investment duration should be aligned

with the

potential need for funds; resulting is a duration target not to exceed

3 years.

All investments are required to exceed a minimum standard of investment-grade

(BBB or Baa)

E. Asset Allocation Policy-Specific to the Excess Reserve Portfolio

Exhibit C (below) reflects the asset allocation recommended by the

Committee

for the Excess Reserve Portfolio.

F. Asset Allocation Policy-Specific to the Title V Grant Endowment Portfolio

Exhibit D (below) reflects the asset allocation recommended by the

Committee for

the Title V Grant Endowment within the stated parameters of the grant

bylaws.

G. Rebalancing

-

- It is expected that the Endowment Portfolio’s actual asset allocation will vary

from its target asset allocation as a result of the varying periodic returns

earned on its investments in different asset and sub asset classes. The

Endowment and Excess Reserve Portfolio will be rebalanced to its target

normal asset allocation under the following procedures:- The investment manager will use incoming cash flow (contributions) or

outgoing money movements (disbursements) of the Portfolio or realign the

current weightings closer to the target weightings for the Portfolio. - The investment manager will review the Portfolio quarterly to determine the

deviation from target weightings. During each quarterly review, the following

parameters will be applied:- If any asset class (equity or fixed income) within the Portfolio is +/-5 percentage points from its target weighting, the Portfolio will be rebalanced.

- If any fund within the Portfolio has increased or decreased by greater than 20% of its target weighting, the fund will be rebalanced.

- The investment manager may provide a rebalancing recommendation at any time.

- The investment manager will use incoming cash flow (contributions) or

- Performance shall be measured on a total return, time-weighted basis and

presented for the most recent quarter, year-to-date, and the trailing years,

three years, and five years. Performance for periods greater than one year

shall be expressed on an annualized basis. To facilitate performance

comparisons, investment results should be expressed both gross and net of

fees. - The specific performance objective is to attain, within acceptable risk levels,

an average annual long-term total return that meets or exceeds the sum of

the Foundation’s spending rate plus inflation (as measured by the CPI,

consumer price index) plus investment management and related fees. In

cases where the Foundation is appointed trustee of a charitable trust, the

investment objective is to achieve a return that satisfies the distribution rate

while retaining as much corpus as possible.

- It is expected that the Endowment Portfolio’s actual asset allocation will vary

G. Reporting

Investment reports shall be provided by the investment manager(s)

on a (calendar) quarterly basis or more frequently

if requested by the Committee.

Each investment manager is expected to be available to review portfolio

structure, strategy, and investment performance annually with

the Investment Committee.

Appendix

Investment and Spending Policy Flow Chart

Exhibit A: Asset Allocation Guidelines for the "Endowment Portfolio"

Exhibit B: Asset Allocation Guidelines for the "Reserve Portfolio"

Exhibit C: Asset Allocation Guidelines for the "Excess Reserve Portfolio"

Exhibit D

a) A grantee shall invest, for the duration of the grant period, the endowment fund established under this part in savings accounts or in low-risk securities in which a regulated insurance company may invest under the law of the State in which the institution is located.

(b) When investing the endowment fund, the grantee shall exercise the judgment and care, under the circumstances, that a person of prudence, discretion and intelligence would exercise in the management of his or her own financial affairs.

(c) An institution may invest its endowment fund in savings accounts permitted under paragraph (a) of this section such as—

(1) A federally insured bank savings account;

(2) A comparable interest-bearing account offered by a bank; or

(3) A money market fund.

(d) An institution may invest its endowment fund in low-risk securities permitted under paragraph (a) of this section such as—

(1) Certificates of deposit;

(2) Mutual funds;

(3) Stocks; or

(4) Bonds.

(e) An institution may not invest its endowment fund in real estate.

Administrative Procedures for providing to the Committee the Information they Need to Establish the Spending Policy

Established by Management: 11/10/2016

- Within 60 days following the end of the calendar year, Management will

provide to the Finance Committee the following information:-

- Rate of returns on the Endowment Fund for each of the three previous

calendar years - Recommended spending rates based on the three-year trailing

average value for the Endowment Fund and normal accounting

procedures. The recommendations will include:- Endowment management fee, not to exceed to 2% (currently

1.5%) - Recommended charitable purpose spending rate that is

compliant with prudent management and industry best

practices.

- Endowment management fee, not to exceed to 2% (currently

- Rate of returns on the Endowment Fund for each of the three previous

-

- The process for allocating endowment earnings are as follows:

- In accordance with Board policy, the endowment management fee (currently set at 1.5%) is allocated first to the operational fund for the Foundation.

- Funds are secondly allocated for charitable purposes (currently set at 3.5%) as designated by the donor or for allocation by the Board.

- The calculation that is currently used to establish the Foundation maximum

spending is as follows: 1.5% (endowment management fee + 4% (charitable purpose allocations) = 5.5% (maximum spending limit as established by policy)

- When earnings are below the Board’s established spending limits:

- If the three-year average growth rate of the Endowment Portfolio were to decline, and 5.2% was determined to be the prudent maximum spending rate, the calculation to derive charitable spending would be: 5.2% (earnings) – 1.5% (endowment management fee) = 3.7% for charitable purpose allocations.

- Adjusting the endowment management fee: In the occurrence when endowment

portfolio earnings drop below 5.5%., the Finance Committee may consider reducing

the 1.5% endowment management fee, so long as the funding provided is adequate

to fully fund the Foundation’s business and operating costs, including essential and

productive staff positions. If the management fee is to be reduced, the reduction

should be proportional. Here is an example:- The 1.5% endowment management fee expressed as a percentage of the 5.5 distribution is 27.27% (1.5%/5.5% = 27.27%) Therefore, if the earnings were to decline to 4.9% and the Committee agreed to proportionally reduce the management fee, the calculation would be as follows, (4.9% x 27.27%) / 100 = 1.34%. This would provide a 1.34% spending rate for charitable purposes.

**Approved by the MCCF Board on August 27, 2024